Insurance for building and plumbing work

Homeowners and renovators are protected from faulty building and plumbing work by insurance held by the builder or plumber.

Domestic building insurance

Domestic building insurance (DBI) is provided by a builder when the cost of building work under the contract with the builder is more than $16,000 (including labour and material costs). DBI will cover costs up to $300,000 to fix structural defects for six years, and non-structural defects for two years.

DBI provides cover to homeowners for incomplete or defective building works. A claim against this insurance can only be made if the builder dies, goes bankrupt or otherwise cannot be found. In some circumstances, for DBI policies issued after 1 July 2015, you can make a claim if your builder has failed to comply with a tribunal or court order. For more information, visit the Domestic Building Insurance section of the Victorian Managed Insurance Authority's website.

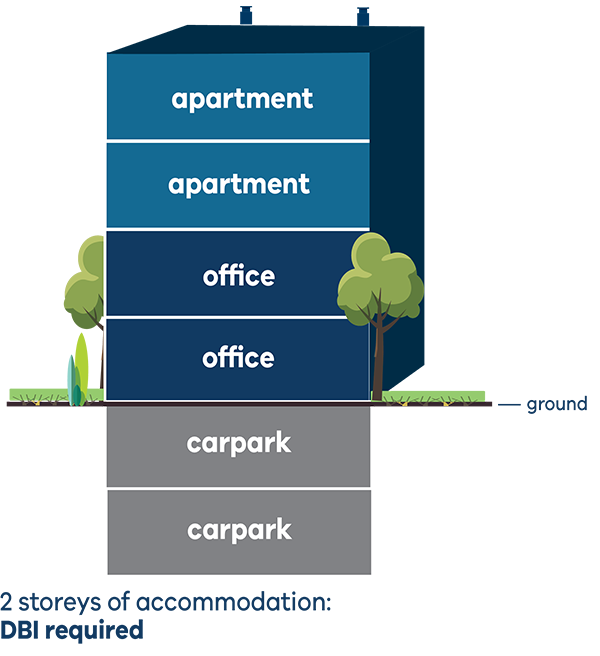

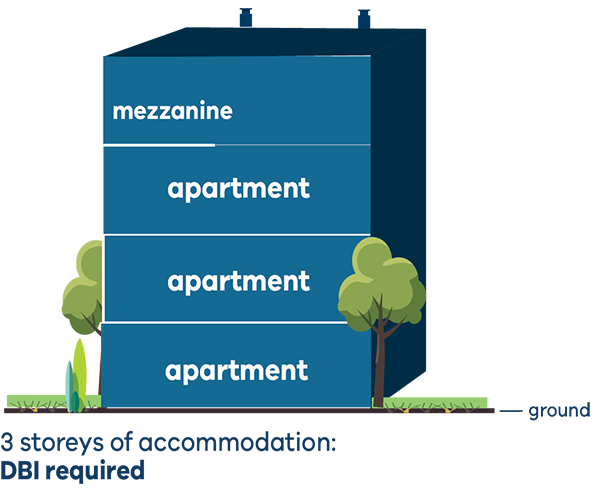

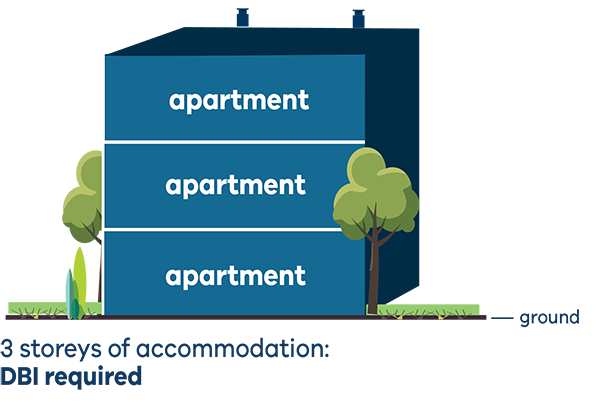

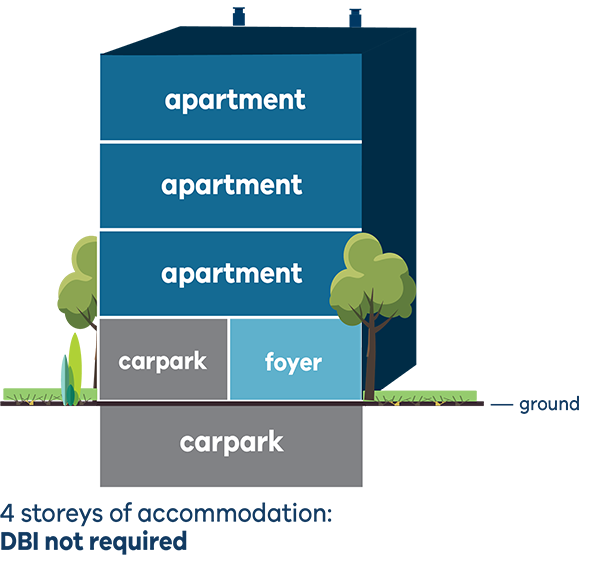

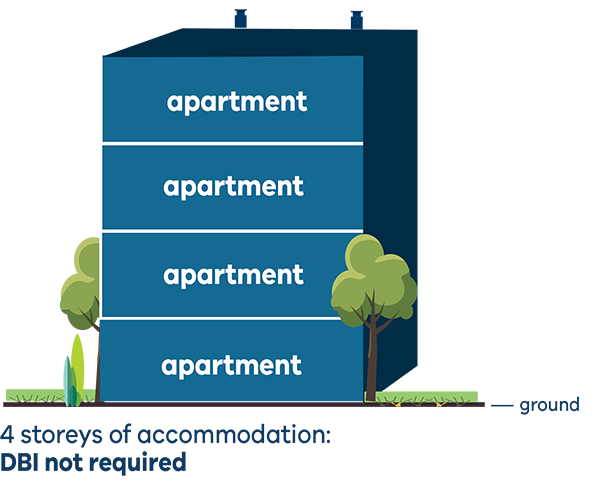

DBI exception – multi-storey buildings

If you own or are buying an apartment in a multi-storey residential building, you should be aware there are exceptions to the DBI requirements for these types of buildings. In general, DBI is not required for multi-storey residential buildings containing more than three storeys of accommodation. Please note: an entrance foyer and storage area will define a storey as accommodation, even if the remainder of the storey is for carparking.

|

|

|

|  |

Plumbing insurance

As a consumer, using an appropriately licensed plumber to carry out your work offers you protection because they have the required level of insurance to cover any defective work.

Licensed plumbers are required by law to obtain insurance before being licensed by the VBA.

Plumbing work covered by insurance

All licensed plumbers must be covered by insurance when carrying out plumbing work that requires a compliance certificate. Work that requires a compliance certificate is:

- any plumbing work that has a total value of $750 or more, including labour, materials, appliances and fixtures, regardless of who purchased them

- all work carried out on below ground sanitary drains

- all work involving the installation, relocation, replacement or conversion of any gas-using appliance

- all work involving the installation, modification or relocation of consumer gas piping

- all work involving the construction, installation, relocation, alteration or replacement of cooling towers.

The required insurance coverage includes:

- rectifying defective plumbing work that does not comply with plumbing standards

- trade practices liability

- consequential loss and non-completion. For example, if you suffer a loss because the work was not completed due to the plumber passing away or having their licence suspended, or if you ended the contract because the licensed plumber wrongfully refused to complete the work

- public liability, where the work carried out results in personal injury or damage to property.

Period of insurance coverage

The compliance certificate for works undertaken by a practitioner guarantees the workmanship for a period of 6 years.

The insurance coverage should cover this 6 year period regardless if the plumber ceases to operate as a licensed practitioner, retires or ceases plumbing work.

Public liability insurance is also included for six years from the date the work was completed or from the date the licensed plumber provided the consumer with the compliance certificate for the work.

Limits of required insurance coverage

There are limits on how much can be paid out under the insurance for particular claims.

In brief, the limit for public liability is $5,000,000 for any one claim, and for all other claims:

- relating to domestic plumbing work: $50,000

- relating to non-domestic plumbing work: $100,000 for any one claim or series of claims.

Resolving problems

If you have any concerns about the plumbing work carried out by a licensed plumber, you should contact the plumber first to discuss your concerns and give them an opportunity to reassess and rectify any defective work.

If the issue is not resolved, you can lodge a complaint with the VBA. See VBA complaints process. We have powers to compel plumbing practitioners to rectify any defective or non-compliant plumbing work that we identify.

Release of plumber insurance details by the VBA

It is recommended that consumers give licensed plumbers the opportunity to return to rectify non-compliant plumbing work if they are still licensed and able to attend. If you do not want the licensed plumber to rectify the work, or the person is no longer licensed or able to carry out work, you can make a claim on the plumber’s insurance within six years of the work being completed.

The VBA holds details of the insurance policies of licensed plumbers due to its registration process for these practitioners, however as it is not a public registry it cannot release these directly to a consumer. If a consumer wishes to make a claim on a plumber’s insurance, they may seek these details from the licensed plumber directly, or it will be necessary to request access to the details via the VBA Freedom of information process.

The required insurance is prescribed by the Victorian Government in Ministerial Orders signed on 20 June 2002.

The VBA is unable to assist if an insurance claim is not successful or you are dissatisfied with the outcome of the claim. A dispute about the insurance claim can be resolved at the Victorian Civil and Administrative Tribunal (VCAT).

Please note that a licensed plumber may choose not to return to rectify work and to release their insurance details to a consumer themselves.